Lithuania is one of the most attractive countries to foreign investors. The World Bank ranks Lithuania as the 11th most business-friendly country in the world. Germany is ranked in 22nd place, Ireland – 24th, and Switzerland – 36th. The Doing Business ranking is calculated by comparing regulations in 11 areas of business in 190 countries. The evaluation shows that Lithuania offers excellent business conditions for foreign investors.

Lithuania’s most important advantages for those doing business:

- Stable political and economic environment

- Support from municipalities

- Well-developed infrastructure

- Well-developed logistics

- Well-developed IT infrastructure

- Convenient location

- Competitive labour costs

- Talented and hard-working labour pool

- Strong work ethic.

International companies value Lithuanian employees for many reasons. The employees are able to learn quickly and have a strong sense of responsibility. Lithuania has raised a generation able to communicate in many languages, including English, German, Swedish, Danish, Norwegian and others.

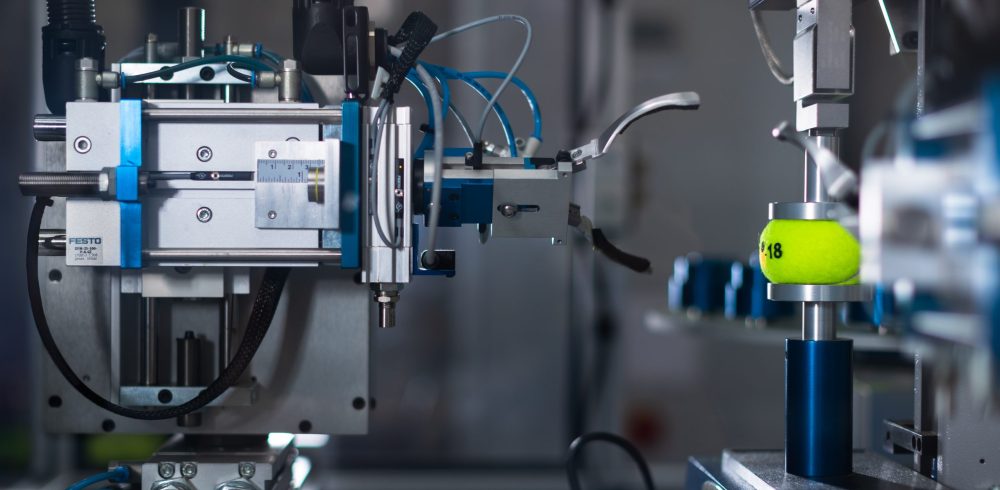

Potential investors are invited to learn more about two of the stronger Free Economic Zones in Lithuania, which welcome companies in the engineering, automotive, manufacturing, logistics and related business fields.

The first, Šiauliai FEZ, is situated in the northern part of Lithuania. Well-known companies such as Bär Cargolift (Germany) and PLUS Windows UAB (Norway) have chosen to build facilities in the Šiauliai FEZ. The core competence of Bär Cargolift is continuous enhancement in the performance of tail-lifts. PLUS Windows UAB, an investor from Norway, is a manufacturer of PVC windows and doors.

The second, Kėdainiai FEZ, has been chosen by the Linde Group (Germany), a world-leading supplier of industrial, process and speciality gases. Located in the very centre of Lithuania, the site’s infrastructure, ideal location, costs and speed of implementation have proven to be convenient and attractive.

Unique economic and legal conditions in the Kėdainiai and Šiauliai FEZ:

- No corporate tax for the first 10 years, followed by 7.5% corporate tax for the next 6 years, when investments in fixed assets are at least EUR 1 million.

- No real estate tax.

- No dividend tax for foreign investors in the Šiauliai or Kėdainiai FEZ.

- The plots may be customised to fit customer needs.

- Projects take between 9 and 12 months from idea to completion. More information: investmentpartner.lt

Manufacturing & Engineering Magazine | The Home of Manufacturing Industry News