Griffin Global Asset Management and Bain Capital Special Situations Have Agreed to Acquire a Pool of Rolls-Royce Spare Engines

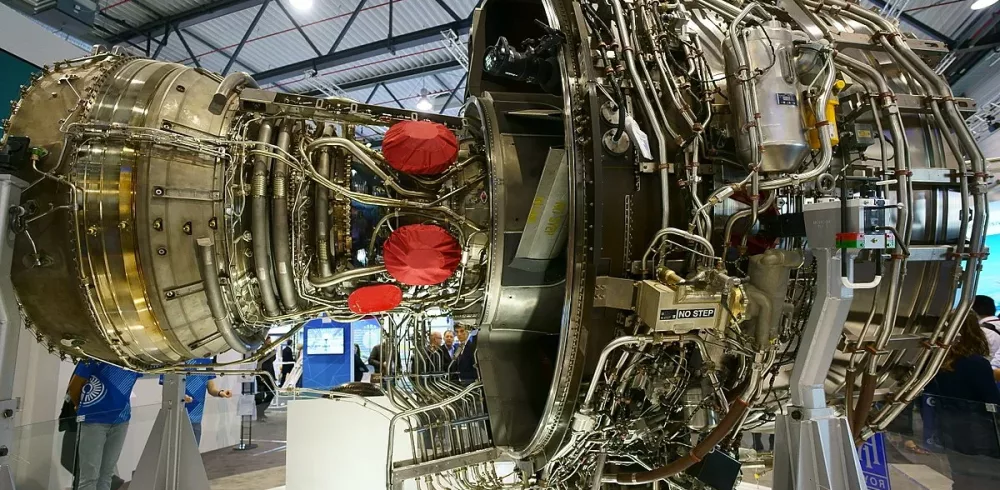

Griffin Global Asset Management (“Griffin”) and Bain Capital Special Situations (“Bain Capital”) today announced they have agreed to acquire 17 new technology Rolls-Royce Engines, including Trent XWB-84s, Trent XWB-97s, Trent 1000s, and Trent 7000s. The engines will be owned by a newly formed standalone entity and used as spares by the Rolls-Royce global customer base.

This transaction further demonstrates Griffin and Bain Capital’s ability to provide bespoke solutions to airlines, original equipment manufacturers, and others across the industry.

”We are excited to have completed this transaction with the Rolls-Royce team and look forward to supporting their customers over the coming years,” said Ryan McKenna, Chief Executive Officer of Griffin.

“This transaction is emblematic of our ability to provide scale and flexible solutions to support leading companies across the aviation sector,” said Matt Evans, a Partner at Bain Capital.

Bank of America, N.A. led the acquisition financing of the engines, with key commitments to the facility from Mizuho Bank, Ltd., Citibank, N.A., and Goldman Sachs Bank USA.

Hughes Hubbard & Reed LLP and Akin Gump Strauss Hauer & Feld LLP acted as legal advisors to Griffin and Bain Capital, while Milbank LLP acted as legal advisors to the Lenders.

About Griffin Global Asset Management

Griffin is a commercial aircraft leasing and alternative asset management business with offices in Dublin, Ireland, Puerto Rico, and Los Angeles, CA. Griffin’s team of aviation professionals works closely with airlines, OEMs, and financiers to deliver customized fleet solutions and innovative financing products to airlines globally.

For more information visit www.griffingam.ie or www.griffingam.com

About Bain Capital Special Situations

Bain Capital Special Situations is a global team of investors who have driven value creation for more than 20 years. Bain Capital Special Situations has $19 billion in assets under management and has invested more than $28 billion since our inception in 2002. We provide bespoke capital solutions to meet the diverse needs of companies, entrepreneurs, and asset owners. Across all market cycles, the strategy brings together credit, equity, corporate and real asset expertise to partner where traditional providers cannot. Our dedicated, global team of more than 100 investment and portfolio professionals contribute the local expertise and capabilities that enable these diverse investments. For more information, please visit: https://baincapitalspecialsituations.com/

Manufacturing & Engineering Magazine | The Home of Manufacturing Industry News