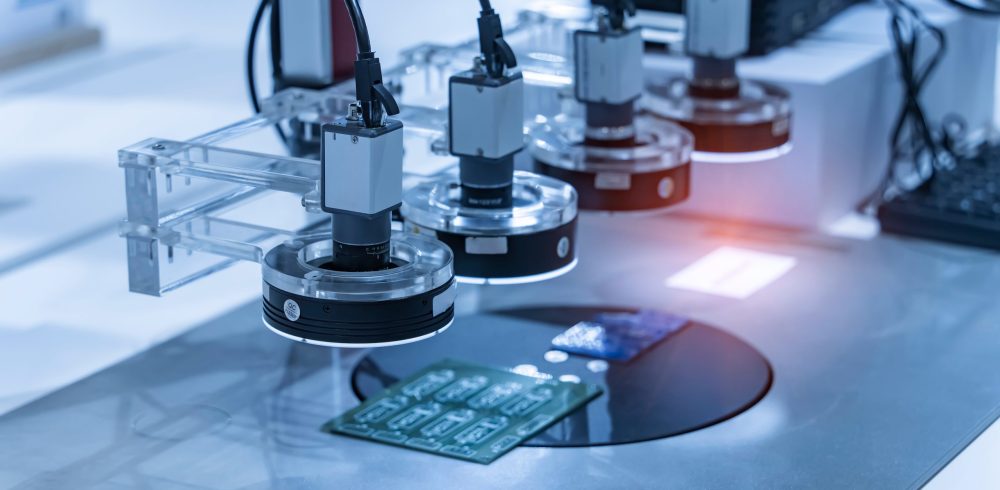

The global market for Machine Vision declined by 3.9% in 2024 as global industrial automation markets struggled due to challenging macro-economic growth, according to Interact Analysis. However, the market intelligence specialist forecasts a return to revenue growth from 2025, despite worldwide uncertainty caused by the introduction of US trade tariffs by the Trump administration.

A contributing factor to the overall decline of machine vision revenues was excess inventory, which customers and distributors worked through in 2024. This led to a decrease in purchases of new machine vision products over the year. Many end customers also performed badly in 2024, with the general slowdown in manufacturing having a significant impact on the worldwide machine vision market.

Despite the decline of the machine vision market and the uncertainty caused by US tariff announcements, Interact Analysis projects market growth of 1.5% over the year to reach $5.7 billion. The general outlook for manufacturing and machinery production is starting to strengthen, driving machine vision growth in 2025 and the market is projected to reach a value of only $7 billion by 2028 (slightly lower than previous forecasts).

Global machine vision revenues are expected to return to growth in 2025, strengthening out to 2029

Area scan cameras suffered the largest decline

While the overall Machine Vision market suffered a decline in 2024, area scan cameras suffered the sharpest decline (-7.8%). Area scan cameras are arguably the largest sub-segment of the machine vision market, ahead of configurable vision systems and 3D cameras. However, the segment had the toughest year, with the decline due to a number of factors, including continued drawdown in inventory and increasing price pressure from APAC vendors.

Impact of tariffs on machine vision market recovery

The constantly changing tariffs from the Trump Administration in the US have caused uncertainty in many markets including the machine vision market. The impact of this can be seen in the machine vision market from the second quarter of 2025, with many end customers adopting a ‘wait and see’ attitude and market growth constrained in the short-term. Despite this, market expansion is still forecast in 2025, with long-term demand for machine vision products remaining strong. Companies are continuing to invest in automation, while others are mitigating the impact of the tariffs by diversifying their supply chains and tracking tariff shifts. Furthermore, a number of Chinese machine vision vendors are looking to re-direct their overseas expansion strategies to Europe or other Asian countries instead of the US.

Commenting on the latest Machine Vision report, Jonathan Sparkes, Research Analyst at Interact Analysis, says: “Looking ahead, the outlook for 2025 is proving to be much more subdued than previously expected, with additional uncertainty in the market coming through as a result of the threat of tariffs. However, into 2026 and beyond, our belief is the fundamentals for the industry remain strong and the expectation is for a return to levels of growth more inline with our previous projections.”

Manufacturing & Engineering Magazine | The Home of Manufacturing Industry News