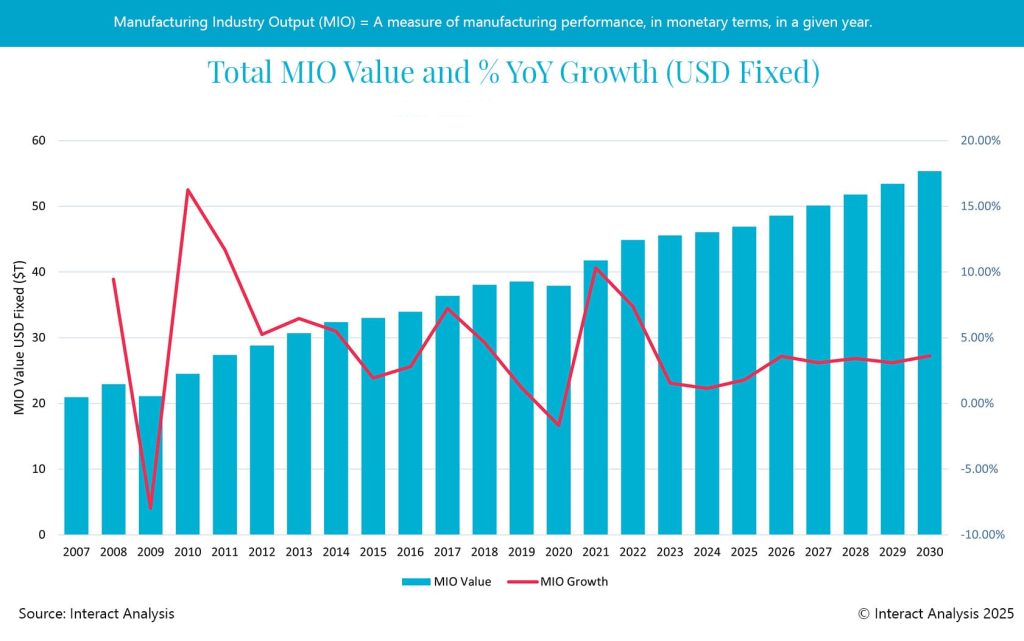

In early 2025, the manufacturing sector was looking bright with a year of strong growth expected, according to Interact Analysis. The US and China regions were showing signs of rapid growth, with European regions appearing to shake off the stagnation of recent years. However, with US President Trump’s ever-changing tariffs, the market intelligence specialist has revised down its forecasts for manufacturing sector growth across the major economic regions, predicting that the manufacturing recovery will now gain momentum in 2026 rather than 2025.

Manufacturing industry recovery is now expected to pick up momentum in 2026 rather than 2025

Trump’s tariffs affect regions differently

According to Interact Analysis’ Manufacturing Industry Output (MIO) Tracker, regions across the world are being affected differently by tariffs the US administration is imposing. Both Europe and the US are expected to see growth squeezed because of the charges, with the MIO growth forecast for the US reduced from a possible 4% to just 0.9% in the wake of tariff & uncertainty effects. US manufacturing industry growth has been downgraded due to the supply side exposure the US has to imports for its largest industries. The longer tariffs and uncertainty around them continue for, the less likely the newly-projected growth will be met.

Meanwhile, the Eurozone’s manufacturing sector is expected to shrink by 2.4% in 2025. This is due to the vulnerability of the bigger players in the industry, which depend on the US as a major export market. This is a similar situation for Switzerland, the UK and Norway, with a challenging year predicted for all three. However, Turkey is predicted to see strong growth in the manufacturing sector, caused almost entirely by inflation.

In contrast, the manufacturing sector in Asia is expected to grow by 2.7% overall, with China expanding by an anticipated 2.9%. Interact Analysis sees long term growth potential in the APAC regions, including China, so long as they can negotiate balanced trade deals with the US.

Impact on the machinery sector

The global machinery sector is under growing pressure due to the economic uncertainty that comes with unpredictable tariff policies. The reliance the US has on imported machinery parts and components has increased the impact of new trade barriers, which is contributing to a downgrade in expected manufacturing growth. Europe’s machinery exporters, especially Germany and Italy, are getting prepared for decreased demand from the US. However, Asian economies are expected to grow their machinery sectors if stable trade deals are forthcoming.

Commenting on the latest MIO report, Jack Loughney, Lead Analyst for the MIO Tracker at Interact Analysis, said: “Overall, the growth that was expected in 2025 is not achievable due to the ongoing tariffs policies but there’s hope for some stabilization in 2026. Trump’s tariffs have put a dampener on what was expected to be a good year for global manufacturing and we have now downgraded a majority of our projections as a result of the rapidly changing climate and the continuing threat of a tariff war.”

About the report

In a fast-moving sector with complex correlations, it is critical to understand the state of the market now, where it was, and where it will be. This report quantifies the total value of manufacturing production with deep granularity – for over 102 industries, across 45 countries, and presenting 18 years of historical data – for a complete business cycle, pre-recession to the present day.

We have carefully organized the country data around a common taxonomy to provide easy-to-interrogate, like-for-like comparisons. Credible five-year forecasts round out the view.

About Interact Analysis With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth. To learn more, visit www.InteractAnalysis.com

Manufacturing & Engineering Magazine | The Home of Manufacturing Industry News