Manufacturing Businesses Some of the Least Prepared for Brexit deadline

Almost two in three UK businesses (63%) say they will not be ready for Brexit by 31 October – and 26% say they need a further 6-12 months to get their company Brexit-ready – according to new research by ThoughtWorks, the global software consultancy, to find out about the manufacturing sector. The national survey asked 1,026 business leaders how long it would take their business to adapt to the key regulatory, economic and data issues that will come as a result of Brexit. There was little variation between a hard or soft Brexit on business readiness (37% for both scenarios). Only 14% of business said they were already fully prepared for Brexit – and whilst this rises to 37% being ready by 31 October – the majority are calling for more time, with 9% of respondents saying they will never be ready. Brexit readiness by sector Businesses in the construction sector were those most likely to say they would be ready for the impact of Brexit by the end of October – whereas those in manufacturing and the education sectors were least likely to be fully prepared. Businesses in retail (31%), health (29%) manufacturing (29%) were most likely to say they would need a further 6-12 months to adapt to the key regulatory, economic and data issues that they believe will come as a result of Brexit. How long businesses need to adapt to the key regulatory, economic and data issues that will come as a result of Brexit: Percentage of business that are ready now or will be by 31 October – by sector. In event of a hard Brexit In event of a deal Brexit Construction 41% 38% Tech & Media 40% 40% Health 39% 34% Retail 35% 36% Finance 35% 39% Public Sector 33% 34% Manufacturing 30% 30% Education 29% 35% Professional services 27% 20% Brexit readiness by business size The ThoughtWorks research also found that the size of a business also had a bearing on its perceived readiness for Brexit. Nearly a quarter of small businesses (23%) said they were prepared for the upcoming deadline compared to just (7%) of larger companies[1]. Brexit readiness by city The ThoughtWorks study also explored business sentiment across UK cities. Whilst London is seen to be at the centre of Brexit debate, it was firms in Leeds and Birmingham that were most likely to be fully prepared for the key impacts of Brexit (for both a deal and no deal scenario). In Manchester, business leaders were most likely to say they needed an additional 6-12 months to be ready for the impact of Brexit on their company (39%). Some were calling for even more time – around a quarter of businesses in the Newcastle said they needed until 2021 to be ready (23%) – and some businesses in Liverpool needed five years (13%). Looking at the regional picture, businesses in Scotland and the north were least likely to be prepared for Brexit on 31 October. How long businesses need to adapt to the key regulatory, economic and data issues that will come as a result of Brexit: Percentage of business that are ready now or will be by 31 October – by city. In event of a no deal Brexit In event of a deal Brexit Leeds 57% 46% Birmingham 47% 41% Bristol 40% 29% Cardiff 38% 33% Nottingham 36% 34% London 36% 32% Glasgow 33% 36% Edinburgh 31% 31% Manchester 30% 33% Liverpool 29% 29% Newcastle 28% 22% Kevin Flynn, Director at ThoughtWorks UK commented: “After a period of unprecedented economic and political uncertainty, we asked businesses around the UK how prepared they were for the key regulatory, economic and data issues they believed will result from Brexit. It is a concern that the majority of businesses surveyed say they do not feel they are ready, and this changes little for the deal or no deal Brexit scenarios. “In the weeks ahead, we will look more closely at how businesses plan to adapt to the new post-Brexit era. Supply chain disruption, employment of EU citizens, the falling value of the Pound and transfer of data between the UK and EU are key issues cited today as challenges for businesses. There will no doubt be opportunities from market uncertainty and we expect to see the tech gap widen, as tech-centric agile businesses adapt quickly whilst those whose technology holds them back will likely fall behind or struggle to survive.” Manufacturing & Engineering Magazine | The Home of Manufacturing Industry News

Brexit Uncertainty Is Affecting the Manufacturing Sector

A new survey is showing that South East manufacturers are experiencing far more difficult trading conditions as they enter the autumn due to the Brexit uncertainty dragging on. According to the Q3 Manufacturing Outlook survey published by trade organisation Make UK and business advisory firm BDO, while both output and total orders have remained positive they fell dramatically compared to the second quarter. Output reduced from +42 per cent to +6 per cent in the last quarter while the order balance, despite being positive, has also reduced significantly. This fits with the national picture of output continuing to decline from the first half of the year which was boosted by artificial stockpiling reaching record levels. Export orders also fell in the South East despite a cheaper pound as overseas customers move away from British goods and the global slowdown and trade wars take effect. The more difficult picture is reflected in a number of other indicators. Intentions to recruit and invest have both turned negative showing that the region can not escape the Brexit and trade uncertainty which is hurting other regions. As a result of this mixed picture, Make UK is now forecasting manufacturing growth of just 0.1 per cent in 2019 and a 0.6 per cent in 2020. GDP is forecast at 1.2 per cent in 2019 and 1.6 per cent in 2020. GDP is forecast to be 1.1 per cent in 2019 and 1.4 per cent in 2020. “Industry is facing a perfect storm of factors, compounded by a hard Brexit which could not be coming at a worse possible time,” said Make UK region director for the South East Jim Davison. “In normal circumstances a global slowdown on its own would be enough, but add trade wars and the biggest shock to our economy since the war and there seems little doubt that, barring a remarkable turnaround, the sector is heading for recession.” “Global competition, skills shortages, lack of a coherent industrial strategy from government and continuing technological disruption has made UK manufacturing a challenging sector for decades,” Mark Hutton, head of manufacturing at BDO in Gatwick and Guildford, added. “The long shadow cast by the possibilities of a no deal Brexit and the uncertainty of recent months has only added to the difficulties for manufacturers in the South East. “A cliff-edge decision on a deal or no-deal Brexit will mean a double whammy of continuing weaker demand for products and fundamental disruption to supply chains. The government must strain every sinew to reach a Brexit deal that protects UK manufacturing.”

3 Ways Manufacturing Businesses Can Prepare for Brexit

On 31 October 2019, the UK will leave the European Union (EU). UK manufacturers should and will have been preparing for that date, whether a final Brexit deal is made or not. UK manufacturing is resilient and has a rich history, accounting for nearly half of UK trade. But how will Brexit affect manufacturing? This article will explore that issue and offers three pieces of advice to keep manufacturing businesses moving. How will Brexit affect manufacturing? Brexit will represent opportunities as well as threats, and manufacturing business leaders need to prepare, whatever happens, and irrespective of whether tariffs and non-tariff barriers are put in place. Worldwide, there will be new market opportunities and supply networks to tap into, with room to forge new relationships. In January 2018, the UK government released a white paper with a post-Brexit modern industrial strategy, promising billions of pounds of investment in technology and Industry 4.0, as well as a commitment to play a more active role in boosting the industrial sector. Smart and transformational technology, such as the Internet of Things, may allow businesses to take advantage of what could be on offer. One of the main issues of Brexit for manufacturing companies (and businesses on the whole) is the lack of information on what precisely will happen. Normally when businesses plan, they’re basing plans on hard facts and information. Brexit is different – businesses need to plan with unknowns in mind, even taking speculation and hypothetical scenarios into account. Whatever the future scenario, UK manufacturers and distributors need to make sure they’re prepared with the right tools and insights to make the most of a new era. The most successful companies will have visionary leadership and will play to their strengths while minimising their weaknesses. Three ways to prepare for Brexit Here are three areas that manufacturers need to consider in light of Brexit. 1. Keep goods moving Perhaps the most immediate priority for British manufacturers (and distributors) is to understand how various Brexit scenarios may affect their supply chains and the movement of goods. Considerations include: Tariff exposure and other costs. Compliance – irrespective of a Brexit deal (and free trade agreement between the UK and EU) or no-deal (and the transition to World Trade Organisation rules) goods will need to be declared, with custom procedures applied and opportunities for tax/duty planning. Relationships with suppliers – if manufacturers rely on certain components, understanding how this will work after Brexit will be a priority as lead times may increase. The security of customer relationships and the effect on demand volume, contract terms, pricing and rebates. The potential loss of EU research and development grants, and the impact on product marketing and procurement. UK manufacturers should examine their supply chains closely, taking care to understand where delays may potentially hit the business. They should also make good use of data analytics – this could help them examine how they can consolidate goods and understand if warehouses need relocation. Manufacturers should also be asking their suppliers about their own plans for Brexit. One option for UK manufacturers is to become an Authorised Economic Operator (AEO), which is an accreditation that allows businesses to register to apply simplified customs procedures to fast-track their goods through customers border controls and provides assurance to HMRC that their import/export practice is secure. Supply chain strategies needn’t just be about mitigation. What forward-thinking manufacturers should be looking at is challenging what’s happening in their supply chains and doing things differently. Reducing lead times and deferring the time when any duties need to be paid makes sense in almost every scenario. British manufacturers may benefit from considering trade opportunities with countries outside of the EU, such as China and the US. This will have its own set of challenges when it comes to culture and language. 2. Adopt new technology and innovation The fourth industrial revolution, or Industry 4.0, is already making a considerable impact on British manufacturing. Bringing together technology such as the Internet of Things (IoT), cloud computing and artificial intelligence (AI), UK manufacturers should embrace technology in a post-Brexit world. It offers great opportunities and benefits when it comes to productivity and efficiency. AI and automation for example, provide an opportunity for businesses to scale up volume to meet demand from outside of the EU, helping to keep production costs low and assisting the development of new products for new markets. Automation has already changed manufacturing processes around the world and there will be new systems that can perform tasks normally done by humans, which will save money and improve efficiency. Rather than purchase technology in a haphazard way, it’s vital that UK manufacturers understand the specific business challenges they have and make the right investment, efficiently and effectively, to gain a competitive edge. This is particularly important for large manufacturers, which through research, development and investment could already be familiar with what technology can do for them. They won’t be simply thinking about the latest shiny new tech but rather choosing digital technology that can transform their business processes and which has been validated by similar companies. Ultimately, preparing for Brexit through digital transformation and technology investment is very similar to preparing for any other type of business challenge – finding ways to satisfy customers, create better quality products at lower costs, and making them available to as many people as possible in the global marketplace. 3. Invest in the right people Managing Brexit is also about recruiting and retaining the right staff to drive success. To fully implement the benefits of Industry 4.0, UK manufacturers must have a strategy of upskilling existing employees to deliver digital transformation. Manufacturing is changing. Take 3D printing for instance – additive production techniques have radically transformed production processes. This moves away from traditional subtractive production and the traditional assembly line, and towards a process where skilled engineers design manufacturing products digitally. Of course, the possible restriction of free movement across the EU may cause businesses to face problems of recruiting enough people to run traditional

Ready for a ‘no-deal’ Brexit?

As the risk of a no-deal Brexit grows, the government is warning manufacturers to prepare for the sudden imposition of onerous tariff, customs declarations and VAT import liabilities. These threaten to delay or even block goods moving between the UK and EU, and leave businesses with heavy tax bills. Some post-Brexit friction will be eased by new HMRC emergency measures. However, only 10% of the 245,000 affected businesses have yet registered for these reliefs. So what should you do to survive a no-deal Brexit? Apply for an EORI number to help HMRC identify imports and exports Businesses moving goods between the UK and EU will need an Economic Operator Registration and Identification number (EORI). This is used by HMRC to identify shipments and ensure duties and VAT due has been recorded. Without an EORI number, goods will be held at UK or EU customs. Applying online takes ten minutes, and HMRC will confirm successful applications within 5 working days. Get help on limiting tariffs costs Goods moving between the UK and EU will be subject to tariffs after Brexit. Specialist off-the-shelf software or HMRC training grants are available to help businesses establish the right tariff codes and calculations. HMRC also offers a free binding tariff code service if businesses send in product brochures. Register for Transitional Simplified Procedures (TSP) for speedy goods clearance TSP is a new scheme HMRC launched in anticipation of a no-deal Brexit. It postpones the submission of customs declarations and tariff payments until 1 October 2019. Imports into the UK can therefore pass through customs with limited paperwork or checks. Larger businesses can look at the more wide-ranging Authorised Economic Operator certification. Use Postponed Accounting to avoid VAT payments Post Brexit, 20% VAT will become due on goods being imported into the UK. HRMC will now permit this cash payment to be skipped; instead importers may declare the import VAT in their next VAT return (‘reverse charge’). Written by: Richard Asquith, VP of Indirect Tax at Avalara

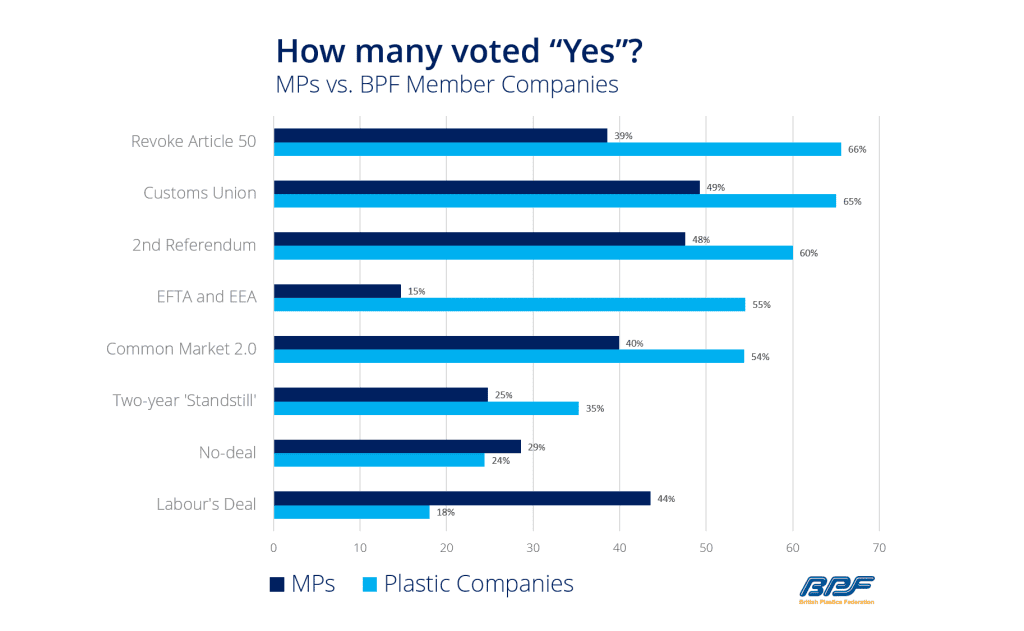

Brexit: How Would the Plastics Industry Have Voted ‘Indicatively’?

The British Plastics Federation (BPF) has surveyed its members in a flash poll that mirrored the ‘indicative votes’ that MP’s voted for in the House of Commons on Wednesday 27 March. Unlike the results from parliament, there are clear preferred courses of action. With over 150 senior industry figures responding in just over 24 hours, the results conclusively rejected a no deal Brexit and showed that a majority of BPF members voted in favour of revoking article 50 to avoid no deal or entering into a customs union. Three quarters of BPF members voted ‘no’ to the concept of a no deal Brexit. The most popular option was revoking article 50 to avoid a no deal situation (66%), followed by entering a customs union (65%) and a confirmatory public vote (60%). BPF members were also asked what their preferred outcome was for Brexit and what they predict will happen. Most respondents preferred either a revocation of article 50 (41%) or a second referendum (23%). However, when they were asked what they predict would actually happen, 29% felt that the UK would end up with an alternative soft Brexit, closely followed by Theresa May’s deal passing (28%). British Plastics Federation Director General Philip Law commented: This flash poll shows there is clearly a dominant view from our industry. The majority of BPF members clearly reject a no deal Brexit and would revoke article 50 to avoid it. The flash poll took place on 27 and 28 March and was filled in by 163 people from across the plastics industry.

Data Protection and Brexit – Is your organisation prepared?

If your organisation shares personal data with businesses or organisations in the European Economic Area (EEA), you will need to take steps to ensure you continue to comply with data protection laws if the UK leaves the EU without a deal. Personal data refers to any information that can be used to identify a living individual, including a customer’s name, their physical or IP address, or HR functions such as staff working hours and payroll details. Although the UK’s own data protection standards would remain the same, there would be changes to how personal data transfers from the EU/EEA to the UK. This could affect your organisation. Therefore, if your organisation receives personal data from organisations in the EU you should consider, with your EEA partners, what changes you may need to make to ensure that data can continue to flow after the exit date. These changes will affect organisations both large and small. It is important for organisations, as a priority, to review whether they would be affected. Practical advice and support is available at ico.org.uk, including ‘Six Steps to Take’ to help you understand the implications and prepare. Minister calls on SMEs to prepare data ahead of EU exit Digital Minister Margot James has issued a reminder to SMEs to ensure that they’ve got plans in place so that they don’t lose access to vital data flows if the UK leaves the EU without a deal. Digital Minister Margot James said: “I know that personal data plays a hugely important role in day to day business. The current uncertainty around Brexit is of great concern and businesses need to take action to limit the risk of potential disruption if a no deal were to happen. I would urge all companies to check the Information Commissioner’s Office guidance on their website, and make sure that they are as prepared as possible.” The Government has already introduced robust new data laws through the 2018 Data Protection Act. This included giving people more power and control over their data and strengthening the powers of the ICO. In the event of a deal, through the Withdrawal Agreement, the government has made plans to secure ‘data adequacy decisions’ from the EU. This will ensure UK and EU firms can carry on exchanging personal data like they do now. For more information you can call the ICO helpline on 0303 123 1113. Prepare your organisation for the UK leaving the EU by answering these 7 simple questions. What does your business do? Do you sell goods in the UK, import or do business abroad? Do you employ anyone from another European country? Does your business exchange personal data with another organisation in Europe? Does your business use or rely on intellectual property (IP) protection? (IP protection includes copyright, trademarks and patents) Does your business get EU or UK government funding? Does your business sell to the public sector? Find out more here: https://www.gov.uk/guidance/using-personal-data-after-brexit

Companies to Attract 20,000 R&D Workers

A new report by Bidwells announced that Science and technology (S&T) companies are looking to attract 20,000 new R&D workers by 2023. Cambridge and Oxford will need around 40 football pitches worth of new lab space to accommodate the next five years of growth. Analysis based on Bidwells’ market data and interviews with 50 leading S&T companies estimates growth in demand for lab and research space of around 2.5m sq ft over the next five years – the equivalent of 60 new labs or 40 football fields* – as investment across the knowledge industries continues to soar. Employment would need to grow by a fifth (22%) to support growth. This could add £2.8bn to the UK economy by 2023, boosting an S&T sector that employs more than 90,000 people in the two cities and is worth an estimated £9.8bn. Bidwells is currently advising on over 10m sq ft of science related real estate for clients such as Trinity College (owners of Cambridge Science Park), Cambridge Biomedical Campus (UK home of AstraZeneca), the UK’s space industry epicentre at Harwell, Oxford, and Imperial College London. The research estimates around 6m sq ft of commercial space across the two cities is currently used for R&D. This includes insight from 50 of the leading global S&T companies represented in the UK in which over half said they plan to increase global spending on R&D over the coming five years. The research said recruitment depends on strong connectivity through quality infrastructure and companies also prioritised the need to have space to grow. Close proximity to academic and research institutions is a key driver of decision making. Brexit was not noted as a major challenge but the impact on recruitment of high skilled international talent is a real concern. Cambridge and Oxford have been two of the UK’s economic success stories outside of London: attracting some of the world’s most advanced science and tech companies – from start-up satellite builders at Oxford’s Harwell campus to biomedical giant AstraZeneca Cambridge – through their two world leading universities and the pool of talent they provide. Future demand will be for a variety of space: wet and dry labs, offices for computer modeling and specialized industrial floorspace for high-tech manufacturing. However, this will place considerable strain on the already constrained commercial markets, and growth risks being stifled by a lack of joined up thinking amongst government and planners. Bidwells, along with other key figures and companies in the two cities and along the “Growth Corridor” that connects them is lobbying for more proactive policy around development: from offices and laboratories to housing and infrastructure. Currently the corridor adds around £100bn to the economy, but has the potential to quadruple this by 2050 if its knowledge based industry receives the support it requires. A recent Independent Economic Review by Dame Kate Barker for the Cambridgeshire and Peterborough Combined Authority said the area needs a package of infrastructure projects to double the size of the economy, while housing shortages will stifle business by deterring staff relocation. It warned the government needs to adopt a ‘Cambridge or overseas’ mentality towards knowledge-intensive business and recognise many companies will relocate abroad if the area is no longer fit for purpose.

Ditch the Fear, Embrace Innovation

Ditch the Fear, Embrace Innovation : The UK is open for business – and it is time to step outside this vicious circle that is driving confidence down to an all-time low. Whether it is businesses leaving the UK or complex customs arrangements, the worse the headlines, the more negative business leaders feel. So how can the tide be turned? The truth is that 5.4 million UK SMEs are not going to throw in the towel; they are going to continue to form the backbone of the UK economy. But to succeed they need support – and that means investment and the creation of a culture predicated on innovation. Successful economies take Research & Development incredibly seriously – it is built in to their DNA. And the UK needs to adopt the same approach. In addition to the Government’s commitment to raising R&D investment in the UK from the current 1.6% of GDP to 2.4% by 2027 – which is a fantastic start – we need to better celebrate our successes in innovation. The future of the UK economy will depend on the creation of an environment that enables SMEs across the country to innovate and succeed. As Adam Kene, Managing Director, Kene Partners, and Danny Lopez, Non-Executive Director, Innovate Finance and member of the Kene Partners Advisory Board confirm, the UK now has a chance to put a flag in the ground, to build on a strong innovation foundation and look forward to a bright future. Attitudes and Culture Pundits may be divided on the UK’s future post Brexit, but one fact is absolutely key: the response of businesses of every size must be proactive. It is time to innovate, to look for new markets and take the fight to the competition. Key to this approach is a cultural shift – a willingness to explore new opportunities, to invest in innovative ideas and build stronger links between business and academia. This is not new: while the UK may not have the same level of R&D investment as other countries, we have an extremely strong track record in technology and innovation – as well as a foundation of government tax incentives and investment. The foundation is there; the fundamental requirement now is to place innovation at the centre of every business’ agenda – and to ensure that every company, irrespective of size or market focus, not only understands but actively explores the innovation led investment opportunities available. R&D Tax Credit The UK’s government’s target of raising R&D investment in the UK from the current 1.6% of GDP to 2.4% by 2027 is bullish – although it falls far short of the 4.25% in Korea and 2.9% in Germany. Clearly private sector investment will form a key component – but the government is looking to lead from the front, with plans to increase the rate of R&D Tax Credit to 12 per cent and invest £725m in the new Industry Strategy Challenge Fund programmes to capture the value of innovation. R&D Tax Credits have been in place for 19 years, yet just 42,000 UK businesses applied for and received funding last year, and the vast majority were first time claimants.They are available for any company that develops new products, processes or services or enhances pre-existing ones. These tax credits can either complement or act as an alternative to innovation grants and are accessible to companies of all sizes and sectors. Conclusion In this post Brexit world, it is essential that the UK is seen as open for business. As a nation we also need to address our well documented productivity issues. And we need to be proactive about gaining access to new international markets to compete on a global stage. We also need to celebrate our successes, and continually reinforce the quality of skills, infrastructure and resources in this country – as well as favourable tax models – to ensure inward investment in the future. Manufacturing & Engineering Magazine | The Home of Manufacturing Industry News

Brexit and the UK Automotive Industry

Brexit and the UK Automotive Industry : Uncertainty around the final Brexit deal between the UK and the EU still remains. This is particularly true for the automotive industry where OEMs such as Ford, Honda and Renault-Nissan have all publicly raised their concerns. To find out what was happening within the industry, OpenText and the Centre of Brexit Studies conducted a comprehensive study focusing on this sector. The research study set out to identify the likely implications that different Brexit options could have on the industry and how prepared organisations were across five key business areas: supply chain management, operations and logistics, human resource management, regulations and compliance, and customer communications. The research drew on many different information resources and included in-depth interviews with senior executives in the UK automotive industry. The research findings suggest that all current available trade scenarios put up different types of trade barriers for the sector, and makes a series of recommendations for risk management and scenario planning strategies that can help companies adapt, whatever the final outcome of Brexit negotiations. Key recommendations include: Automotive companies need to have good enterprise information management (EIM) policies in place for managing and reporting on contracts to implement changes and mitigate risks. OEMs and suppliers need to have a strong information governance strategy in place to ensure compliance with any new regulatory requirements or checks. More emphasis on workforce planning and skills development is needed for the UK automotive industry to mitigate restrictions or changes to the free movement of people. Closer communication and collaboration between automotive manufacturers, partners and customers is needed to ensure a free flow of information. Automotive manufacturers need to have an improved understanding of their supply chain, particularly with respect to any new documentation and compliance requirements that might be put in place. Manufacturing & Engineering Magazine | The Home of Manufacturing Industry News

NFU President Speaks at Oxford Farming Conference

NFU President Minette Batters spoke at the Oxford Farming Conference, challenging the government to make the right decisions regarding Brexit and ensure the nation avoids a no deal. A no deal Brexit could be catastrophic for Britain, according to the NFU and the impacts on the farming industry include: “There have been enough warm words and comfort to us as farmers but now is time for decisions from the government about how it will secure the nation’s food supply. We are less than 90 days away from Brexit and there is still enormous uncertainty about the future and how domestic food production fits into that,” said Mrs Batters. “It is crucial that Government engages with our industry to deliver a sustainable, competitive and profitable British farming sector for generations to come,” she concluded.